Perspectives on Medical Reimbursement

By JR Associates

When medical technology companies develop reimbursement strategies for the U.S. market, it’s a smart business move to look beyond this country’s borders. That’s the advice JR Associates VP of Global Health Policy, Jo Ellen Slurzberg shared in a recent interview with Medical Device Daily.

Jo Ellen acknowledged that planning reimbursement for multiple markets is a complex challenge. However, she explained that it’s also possible to leverage U.S. efforts as a basis for expansion into other countries. Therefore, a coordinated approach can be highly effective.

“You can’t look at regions or countries in a vacuum anymore, because what happens in one is going to affect how others view your product,” Jo Ellen said. “You should assume that you are going to be in all these markets, so you can gain the most out of all the work you’re doing.”

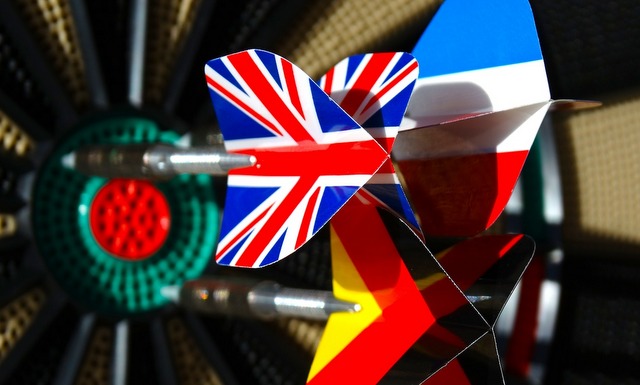

Example: Comparing the U.S. with Germany

How can companies develop a multi-national marketing and reimbursement strategy that more fully applies clinical data and lessons learned? To illustrate this approach, Jo Ellen compared U.S. and German standards and practices.

6 Reimbursement Factors

• Budget Constraints: Hospital costs are very tightly managed in Germany, so companies that are introducing expensive technologies must make a compelling case for adoption.

• Budgeting & Regulatory Cycles: German hospital budgets are developed annually, so timing is a major concern – especially for innovative products that aren’t included in a German diagnostic related group (G-DRG). Similar to the U.S., Germany offers an add-on payment opportunity for innovative technologies (NUB). However, the application requires clinical data from individual hospitals, and manufactures may lack evidence early in the process. Under these circumstances, Jo Ellen suggests patience. “Don’t move too fast, before there is sufficient data. Sometimes the best strategy is to wait.”

• Treatment Setting: In Germany, this can significantly influence payment rates. For inpatient scenarios, coverage typically isn’t an issue, because physicians choose treatments based on standards of care. However, outpatient treatment practices and payment are governed by medical societies. They develop value units associated with various procedures, which in turn determine the level of payment to healthcare providers.

• Physician Pay Structure: Unlike physicians in the U.S., German doctors are salaried. Because they don’t work on a fee-for-service basis, there is no financial incentive to perform more procedures. Product adoption requires fundamentally different marketing logic.

• Treatment Decision Process: Although the UK and other EU countries consider cost-effectiveness when approving treatment, Germany does not. Instead, hospitals examine their own internal costs and offsets for inpatient treatments involving new technologies. Therefore, at minimum, manufacturers must clarify how a product will reduce costs. And, as Jo Ellen explained, “If you want to charge more, you need to demonstrate clearly that the device has greater value, and will offset costs somewhere else in the system.” This may require clinical evidence beyond the country’s regulatory requirements.

• Communication Preferences: In Germany and elsewhere in the EU, formalities are preferred in business interactions. Jo Ellen recommends that manufacturers remain mindful of this, and honor institutional and cultural norms. For example, include titles of business contacts in email messages. Jo Ellen says, “Err on the side of being more formal, and if you do not know, ask.”

Would you like to discuss how your organization can develop a successful multi-national approach to reimbursement? Contact us anytime to schedule a preliminary consultation.

• Learn more about our comprehensive reimbursement services

• Read more articles by and about our consultants

• Visit our Newsroom for more updates and industry alerts